BRANCH AUTOMATION

For financial institutions, the most time-consuming and costly process is cash management. Some studies and customers have reported that nearly 25% of branch operating costs are related to cash handling – counting and sorting currency as it moves into, through and out of the branch.

So it’s no wonder that these manual, labor intensive and time-consuming tasks can result in end of day balancing errors, transaction errors and long wait lines while incurring these costs. Add to that: tying up FTEs and supervisors and creating little revenue for the branch.

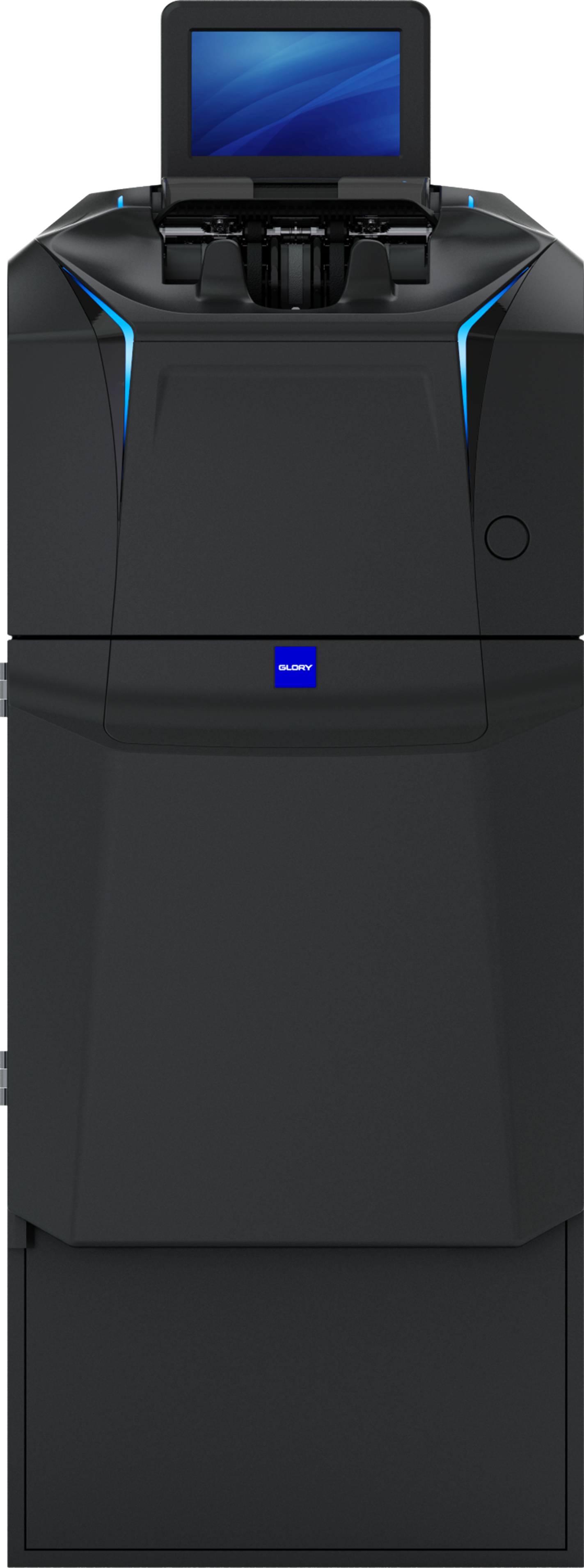

Branch automation and the use of cash recyclers and cash dispensers are efficient and productive solutions to automate these manually intensive and error-prone tasks and reduce security risk. It also frees up staff to be more productive performing daily tasks and creates more revenue generating selling opportunities. It provides built-in dual-custody so that many transactions that previously required two staff members now involve only one. And now, rather than being heads-down counting money, your tellers are free to engage your customers while they’re at the teller window.

Benefits of Branch Automation

Reduced Cost

Enhanced Customer Interaction

Greater Labor Efficiency

Greater Security

The benefits all point to greater profitability, enhanced customer/member interaction